Quick-Start Guide

Getting to know our UI and how to pick between vaults.

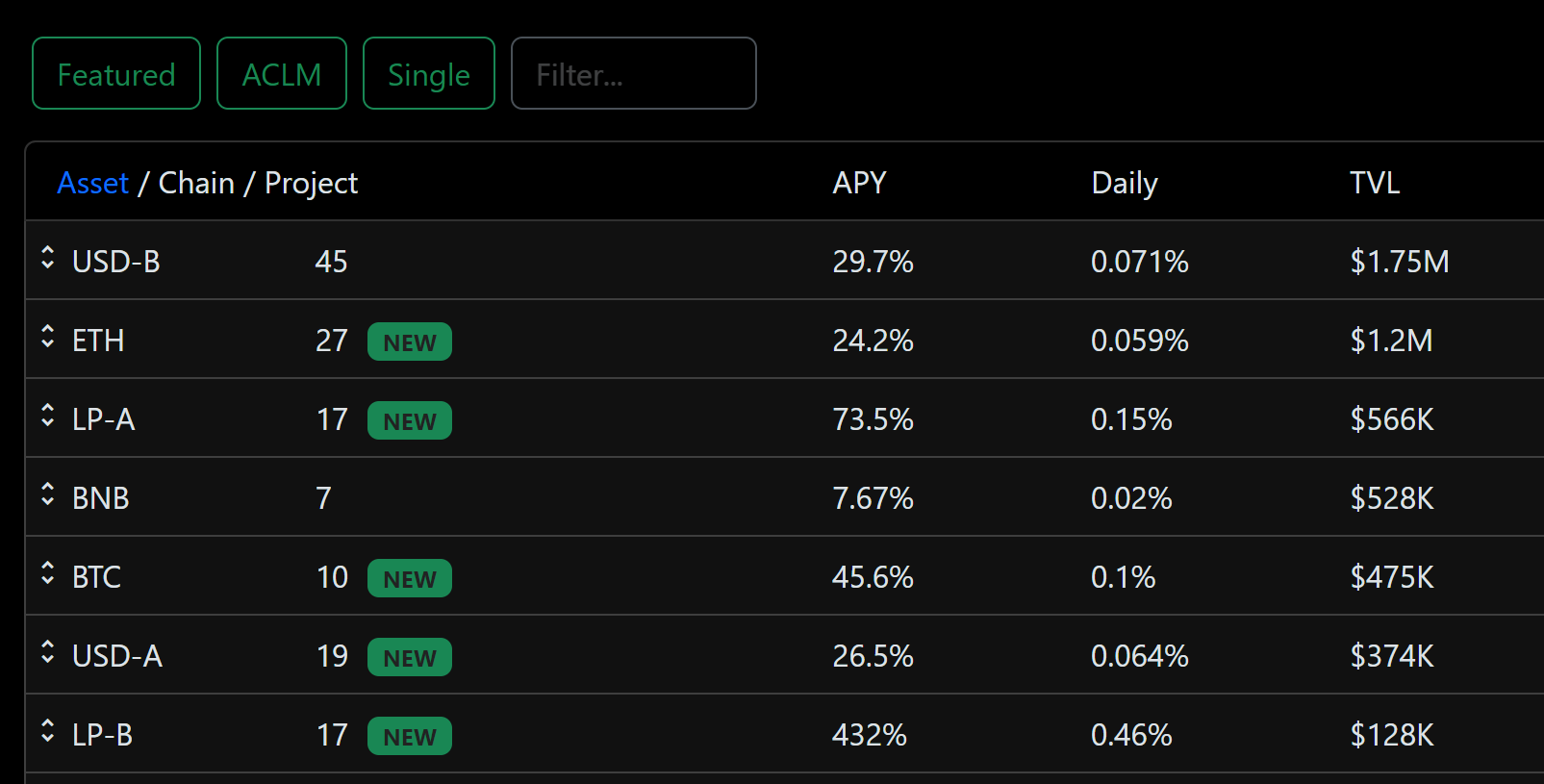

Vault Comparisons

You see some great yields on our dapp: there's Single-Token vaults, and ACLM vaults - but you're not too sure which to pick. What are the risks involved? What tokens do you receive as APY? etc.

This will help you out. 👇

Built On

lending protocols, eg. Venus, Moonwell

CL DEXs, eg. UniswapV3, SushiV3

CL DEXs, eg. UniswapV3, SushiV3

APY Source

supply/borrow APY + lending platform tokens

swap fees generated from trading volume + *Merkl rewards

swap fees generated from trading volume + *Merkl rewards

Strategy Features

self-balancing for optimized highest APY

-single-sided deposits of either token.

-auto range setting to ensure earning of swap fees

-Tightened range for highest stable pair APY

-single-sided deposits of either token.

-auto range setting to ensure earning of swap fees

Examples

-USDT

-wstETH

-BTC

-LINK

-USDC-DAI

-USDC-USDC.e

-wstETH-WETH

-cbETH-rETH

-WBTC-tBTC

-MATIC-USDT

-LINK-WETH

-BTC-WETH

-USDC-XSGD

More detailed comparisons here:

-lending protocol exploits

-no IL risks

-CL DEX exploits

-low chances of IL

-CL DEX exploits

-high IL risks

Considerations

-exposure to 1 token

-slower growth of tokens

-high APY vaults less sustainable (as mainly coming from lending platform tokens)

-exposure to 2 tokens

-higher APY, for relatively low IL risk

-rewards sustainable via swap fees

-exposure to 2 tokens

-highest APY, but gains easily negated by IL

-rewards sustainable via swap fees

Rewards

auto-compounding into deposited tokens

auto-compounding into deposited tokens

auto-compounding into deposited tokens

Notes:

IL: impermanent loss

DEX: decentralized exchange

Categories

A category of higher quality stablecoins vaults, built on USDC and its bridged counterparts.

USDC.e (bridged USDC on chains before USDC was natively available)

axlUSDC (bridged USDC by Axelar)

USDbC (bridged USDC by Base chain)

xcUSDC (XCM protocol USDC on Polkadot parachains)

Examples:

Single-Token Vaults

USDC on Venus (BSC)

USDC.e on Lodestar (Arbitrum)

USDbC on Moonwell (Base)

xcUSDC on Moonwell (Moonbeam)

ACLM - Stable Strategies

USDC.e / axlUSDC on UniswapV3 (Polygon)

USDC.e / USDC on UniswapV3 (Optimism)

USDbC / axlUSDC on SushiswapV3 (Base)

A category of stablecoins from various protocols, ranging from large marketcap to algorithm pegged USD stable tokens. Stablecoin pools paired with USDC also fall under this category.

USDT (USD by Tether)

centralized stablecoin pegged to the US dollar

largest marketcap among stablecoins

DAI by MakerDAO

largest decentralized stablecoin pegged to the US dollar

algorithmically backed by a basket of cryptocurrencies, primarily ETH

USDC.e (bridged USDC on chains before USDC was natively available)

axlUSDC (bridged USDC by Axelar)

USDbC (bridged USDC by Base chain)

xcUSDC (XCM protocol USDC on Polkadot parachains)

xcUSDT (XCM protocol USDT on Polkadot parachains)

Examples:

DAI on Venus (BSC)

USDT on Moonwell (Optimism)

USDT on Mendi (Linea)

xcUSDT on Moonwell (Moonbeam)

FRAX on Lodestar (Arbitrum)

ACLM - Stable Strategies

USDC.e / DAI on UniswapV3 (Optimism)

USDT / BUSD on PancakeswapV3 (BSC)

USDT / USDC on UniswapV3 (Linea)

DAI / USDbC on SushiswapV3 (Base)

A category of various types of wrapped and liquid staked BTC.

WBTC - centralized and largest marketcap wrapped BTC by BitGo

tBTC - decentralized wrapping by Threshold Network

BTCB - centralized and pegged by Binance

BTC.b - decentralized wrapping by Avalanche Network

uniBTC - liquid restaking WBTC by Bedrock

cbBTC - coinbase wrapped BTC

Examples:

Single-Token Vaults

WBTC on Moonwell (Optimism)

WBTC on Mendi (Linea)

BTCB on Venus (BSC)

cbBTC on Moonwell (Base)

ACLM - Stable Strategies

WBTC / BTC.b on UniswapV3 (Arbitrum)

WBTC / uniBTC on UniswapV3 (Optimism)

WBTC / tBTC on SushiswapV3 (Arbitrum)

A category of various types of wrapped and liquid staked ETH.

WETH - wrapped ETH on non Ethereum chains

wstETH - liquid staking ETH by Lido

rETH - liquid staking ETH by RocketPool

cbETH - liquid staking ETH by Coinbase

weETH - liquid staking ETH by Ether.fi

wBETH - liquid staking ETH by Binance

ezETH - liquid restaking ETH by Renzo

Examples:

Single-Token Vaults

WETH on Mendi (Linea)

wstETH on Lodestar (Arbitrum)

cbETH on Moonwell (Base)

rETH on Moonwell (Optimism)

ACLM - Stable Strategies

wstETH / WETH on UniswapV3 (Optimism)

cbETH / WETH on SushiswapV3 (Base)

ETH / wBETH on BiswapV3 (BSC)

Find out more on why our Stable Strategies work so well for LST vaults.

An ACLM category where liquid staked ETH from different platforms are paired together in a pool.

Examples:

ACLM - Stable Strategies

wstETH / ezETH on UniswapV3 (Optimism)

cbETH / rETH on UniswapV3 (Base)

wstETH / rETH on UniswapV3 (Arbitrum)

Find out more on why our Stable Strategies work so well for LST vaults.

A category of various types of wrapped and liquid staked BNB.

WBNB - wrapped BNB by Binance

ankrBNB - liquid staking BNB by Ankr

BNBx - liquid staking BNB by Stader

stkBNB - liquid staking BNB by pSTAKE

slisBNB - liquid staking BNB by Lista (previously Synclub staked SnBNB)

Examples:

Single-Token Vaults

WBNB on Venus (BSC)

ACLM - Stable Strategies

WBTC / ankrBNB on PancakeswapV3 (BSC)

WBTC / BNBx on PancakeswapV3 (BSC)

WBTC / stkBNB on PancakeswapV3 (BSC)

A category of ACLM vaults, consisting of large marketcap token pairs.

WMATIC

WETH

WBNB

WBTC

tBTC

BTCB

BTC.b

OP

ARB

IL is relatively lower than other pairs as prices for large marketcap tokens generally move in the same direction.

*Take note that IL may negate any gains, or result in losses on the intial deposit. Refer to the History Graph in the Advanced section of each vault to evaluate their past performance.

Examples:

ACLM - Volatile Strategies

BTCB / WBNB on PancakeswapV3 (BSC)

WETH / ARB on SushiswapV3 (Arbitrum)

WETH / OP on UniswapV3 (Optimism)

WMATIC / WBTC on UniswapV3 (Polygon)

tBTC / WETH on UniswapV3 (Arbitrum)

A category of ACLM vaults, consisting of smaller marketcap tokens paired with large marketcap tokens.

*Liquidity for our ACryptoS governance token pair ACS / WBNB can be found in this category as well.

Some of the tokens available:

BSW, LODE, VELA, THALES, GMX, XVS, PEPE, CAKE, MAGIC, TIA.n, CRV, UNI, LINK

IL may be higher for these pairs as prices tend to fluctuate much more for lower marketcap tokens.

*Take note that IL may negate any gains, or result in losses on the intial deposit. Refer to the History Graph in the Advanced section of each vault to evaluate their past performance.

Examples:

ACLM - Volatile Strategies

CAKE / WBNB on PancakeswapV3 (BSC)

LINK / WETH on UniswapV3 (Arbitrum)

PEPE / WETH on UniswapV3 (Arbitrum)

CRV / WETH on UniswapV3 (Arbitrum)

UNI / WETH on UniswapV3 (Arbitrum)

BSW / WBNB on BiswapV3 (BSC)

A category of ACLM vaults, consisting of stablecoin tokens paired with mainly large marketcap tokens.

IL may be very high for these pairs as fluctuating token prices are amplified when paired with stablecoin tokens.

*Take note that IL may negate any gains, or result in losses on the intial deposit. Refer to the History Graph in the Advanced section of each vault to evaluate their past performance.

Examples:

ACLM - Volatile Strategies

WBNB / USDT on UniswapV3 (BSC)

wstETH / USDC.e on UniswapV3 (Arbitrum)

MATIC / USDT on UniswapV3 (Polygon)

WETH / USDbC on UniswapV3 (Base)

WETH / USDC on SushiswapV3 (Arbitrum)

A category of stablecoins from different currencies, paired with the USD stablecoin.

IL is minimal, as pegged fiat currencies are much less volatile than other crypto tokens. Token unpeg risk has to be factored in as part of risk assessment as well.

XSGD by StraitsX

EURC by Circle

ACLM - Volatile Strategies

XSGD / USDC.e on UniswapV3 (Polygon)

XSGD / USDC on UniswapV3 (Arbitrum)

EURC / USDC on UniswapV3 (Base)

Risks

DeFi risks are very high compared to traditional finance, ranging widely from market factors to contract exploits. Here are some risks for consideration along with possible mitigations. Factor in your own risk appetite when deciding on which vaults to deposit your tokens in.

Only put in funds you can afford to lose. Do not risk your life savings on DeFi.

General Smart Contract Risks

Smart contracts are vulnerable to exploits. These exploits can result in significant financial losses or other negative consequences. It's crucial to understand the risks involved and avoid interacting with contracts from untrusted sources.

ACryptoS has focused on safety and careful risk assessment since deployment in 2020. Multiple audits and a bug bounty serve to enhance the security. Read our blog here to understand what sets us apart.

Vaults - Underlying Protocol Risks

our Single-Token vaults are built on top of lending protocols. They run the risk where the underlying protocols are exploited, and funds siphoned out via exploiters. We aim to filter out projects via thorough internal due diligence procedures, and try our best to build on safe credible protocols. Over the years since our deployment, despite our best efforts, there have been a few of these protocols exploited with funds unrecoverable (read: Atlantis, Channels, Sonne)

our ACLM vaults are built on top of V3 Conc Liquidity DEXs. In order to minimize the risks of exploits on the underlying DEX, we aim to only build on stronger and battle-tested DEXs like Uniswap, Sushi, and Pancakeswap.

Stablecoin Depeg Risks

protocols issuing USD stablecoins claim to be pegged to USD 1:1, but many smaller marketcap stablecoins are at a high risk of depegging. It may be due to the mechanics behind how the stablecoin is backed, or due to market sentiments resulting in sell-offs, etc.

larger stablecoins like USDC, USDT, DAI, etc have lower depeg risks, though there have been multiple depegging issues over the years as well

LST/LRT Protocol Risks

liquid staking tokens tend to be quite centralized, where user funds like ETH or BNB are held by the intermediary protocol, and staking is done on their back end.

Risks involve protocol exploits, intentional draining of funds, or "depegging" of liquid staked tokens . Lack of liquidity might affect the unstaking of liquid tokens back to the native token as well.

eg. rETH, wstETH, cbETH, stkBNB, ankrBNB, BNBx etc.

please DYOR on how credible and transparent the staking protocols are, as well as how large the market of these tokens are

Bridged Token Risks

it is essential to understand the difference between native tokens and bridged tokens on various chains. Bridged tokens are susceptible to risks and exploits of the bridging protocol itself.

eg. USDC.e is a bridged token while USDC is the native token that is issued directly by Circle. The native USDC token can be redeemed 1:1 to USD via Circle.

eg. Multichain bridge was exploited on multiple chains in 2023. Funds that were lost due to that incident has not been recovered since.

Wrapped Token Risks

Wrapped tokens, while offering convenience, can pose risks. The underlying asset's security and the wrapping platform's reliability are crucial factors. Be cautious of potential vulnerabilities and always research before investing in wrapped tokens.

eg. WBTC is wrapped by BitGo, cbBTC is wrapped by Coinbase etc.

Read more about risks and mitigations here.

Fees

Withdrawal Fees: All vaults have a 0.1% withdrawal fee, calculated by the withdrawal amount.

Performance Fees: already factored into the displayed APY. Full details can be found here.

Tips from the Samurai:

Based on the daily yield rate, try to withdraw only after withdrawal fee is covered. It will be all nett profits from thereon.

All fees go to ACryptoS Treasury, used for frequent buybacks of the $ACS token.

Treasury is owned by ACryptoS DAO ($ACS token holders), managed by a multisig.

Next Steps 🚀

Interested to gain yields via our vaults? Check out this step-by-step visual guide.

Step-by-step GuideLast updated