Liquid Wrapper veNFT + ve(3,3) Vaults

Depositing via our Wrapper vault

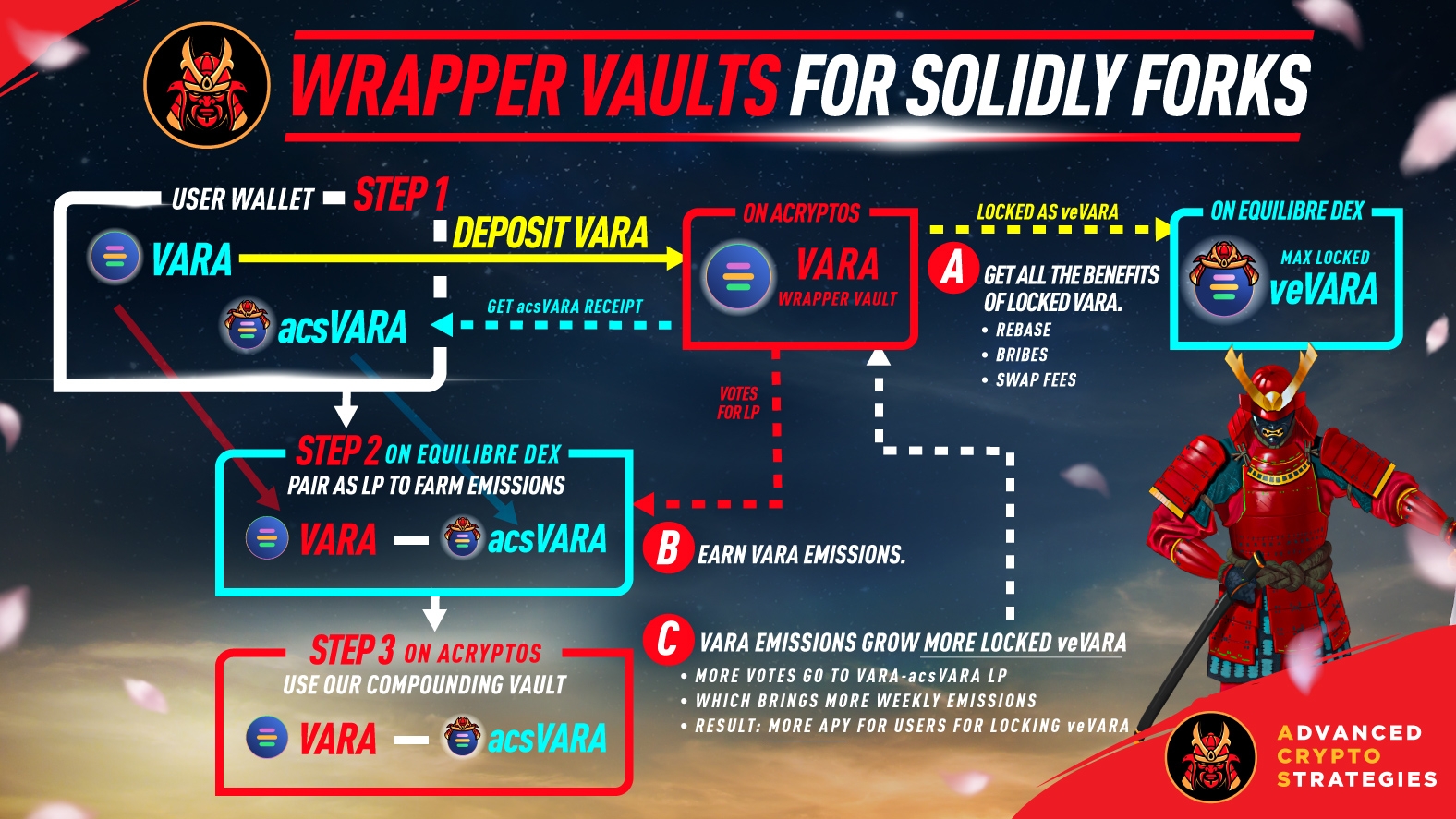

Our Liquid Wrapper Vaults are a set of vaults specially designed to work with ve(3,3) DEXs, allowing liquidity for otherwise locked native tokens, and providing Boosted yields for users. These vaults work cohesively together to form a positive flywheel.

Benefits:

helping ve(3,3) protocols lock more of their native tokens to veNFTs

allowing users to farm higher APY with their tokens without the need to invest in native token veNFTs

How It Works

There are 3 parts to how a user can use our vaults to get maximum benefits.

autoCompunding vaults for Liquidity Pool farms

Liquid veNFT Vault (acs_veNFT)

acs_veNFT-DEXtoken LP vault

*Our Liquid Wrapper Vault mechanics vary depending on different partners. Some ve(3,3) DEX have APY Boosts on their farms while others do not. Check individual docs in the next few pages for full details.

———

1️⃣ autoCompunding vaults for Liquidity Pool farms

These vaults collect DEX native token emissions from the farm, and autoCompound them back into the LP, increasing the number of tokens in the LP

The veNFT in the Liquid veNFT Vault (explained below) will Boost the APY for these vaults, up to 2.5X

Examples (using SolidLizard DEX):

User A forms a ETH-ARB LP, and farms it for 50% APR, manually harvesting the $SLIZ rewards every few days. User A has no Boosted rewards because he doesn't lock $SLIZ for any veSLIZ

User B forms a ETH-ARB LP, and stakes in our ETH-ARB Vault. The $SLIZ rewards are autoCompounded few times a day, swapping $SLIZ to ETH and ARB, forming more ETH-ARB LP, and adding on to the original stake. User B gets 125% APR (2.5X Boosted rewards) even if he doesn't lock $SLIZ for veSLIZ.

TL/DR 👉Users can autoCompound their LP with Boosted rewards, without needing to lock DEX tokens to veNFT themselves.

2️⃣ Liquid veNFT Vault (acs_veNFT)

Users stake their ve(3,3) DEX native tokens in the vault, getting a acs_veNFT receipt token, and get benefits as if they locked veNFT themselves (trading fees/bribes/rebases etc.). Our strategy then locks the tokens for max period, getting max veNFT voting power.

50% of Boosted rewards from ALL LP Vaults launched by ACryptoS on the ve(3,3) DEX, are rewarded to acs_veNFT (veNFT Vault) holders

This veNFT Vault maintains a % Reserve, allowing users to withdraw back the DEX native tokens at any time, where otherwise their veNFT would be locked for 4 years

*Note: Withdrawals are subject to available DEX native tokens in the Vault Reserves. Reserves are constantly topped up from multiple sources (bribes/Boost Rewards etc.). Vault Strategy is based on our Liquidizer Vault (one of our other unique strategies, more info here)

TL/DR 👉

Users stake their DEX tokens, gets full locking benefits without locking, gets rewards APY from all ACryptoS LP Vaults on the DEX

The more DEX tokens staked in the veNFT Vault, the higher the Boosted APY for the LP vaults↩️

The more the LP vaults gain TVL, the more rewards go to the veNFT Vault↩️

3️⃣ acs_veNFT-DEXtoken LP vault

Users can pair their acs_veNFT token (Liquid veNFT Vault receipt) with the DEX token, forming an LP

The voting power from the single-token veNFT Vault will be directed to the acs_veNFT-DEXtoken LP farm *voting strategy might be adjusted after initial launch period, based on TVL and APY

Based on the weekly voting %, the farm receives DEX native token emissions.

Users can form the LP and stake in our acs_veNFT-DEXtoken Vault, autoCompounding more of itself

This LP provides another method for users to exit their acs_veNFT position back to the DEX token

TL/DR 👉 Users get max APY by staking in Liquid veNFT Vault, then using the receipt acs_veNFT token to stake further in acs_veNFT-DEXtoken Vault

Last updated