Advanced Functions

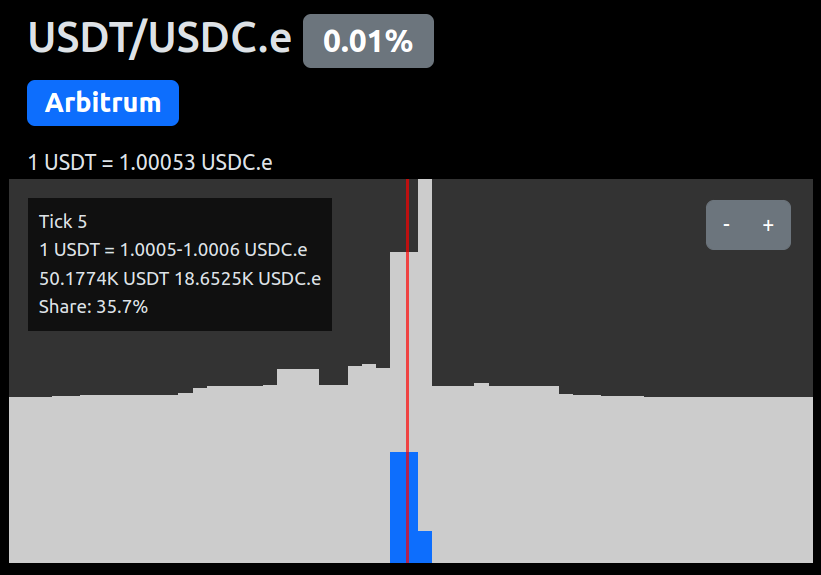

Chart - u3i

We have developed a chart to help users visualize the current distribution of liquidity on a specific LP, the current trading price, and the active liquidity managed by our strategies.

Expanding the "Advanced" section under each ACLM vault, you can find a "u3i" link.

blue bar indicates managed liquidity on ACryptoS

grey bars indicate other providers

large amount of under-utilized liquidity can be seen from the grey bars

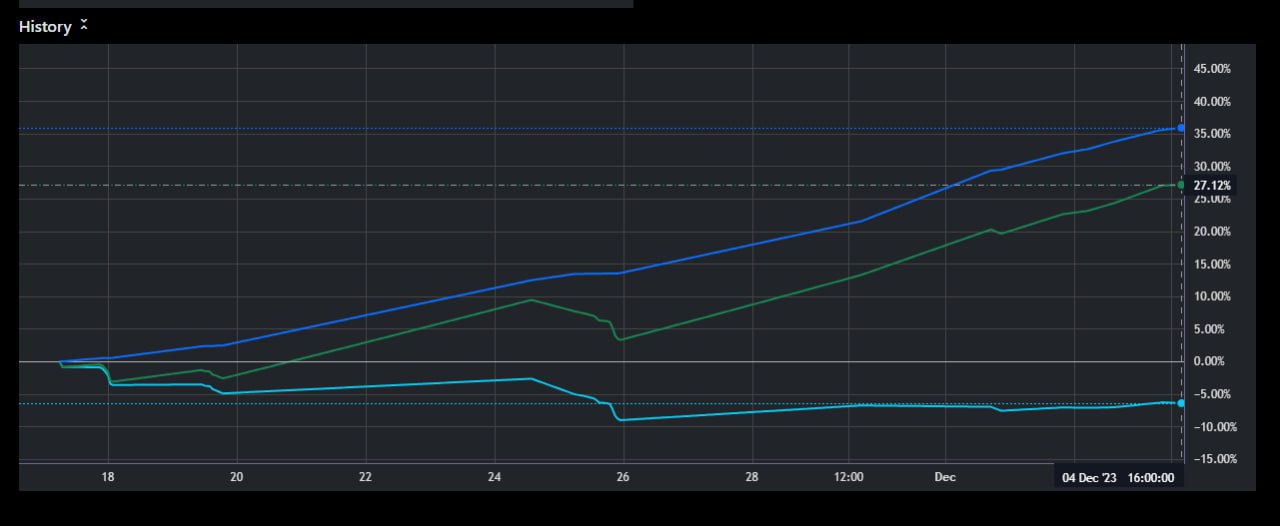

Graph - History

Expanding the "Advanced" > "History" section, you will see a graph indicating the historical performance of this ACLM vault.

The above is a graph for the VELA/ETH vault on Arbitrum Uniswap V3.

blue line is the APY gained

cyan line is the IL

green line is the nett APY

To understand this graph, we look at the green line to find out the actual APY received.

the graph shows a period from 18 Nov to 4 Dec 2023

Green lines shows 27.12% gained from 18 Nov to 4 Dec (18 days)

Converted to APR 27.12% / 18 days * 365 days = 549%

Converted to APY = 23155%

The history graph pulls data from the last 188 harvests of the vault.

ACryptos - Keeper

We developed a Keeper bot, to automate various vault functions based on external triggers. This ensures that our vaults function at the highest effectiveness, and minimizes the potential IL of the vaults.

User Triggers

"Reward" amount refers to the number of vault tokens that a user will receive when the "Harvest Vault" function is triggered. These are called harvester fees (0.3% of the pending rewards), and serves as an incentive to compensate the gas fees used for compounding the vault.

Harvester rewards are received in the form of the vault acsXYZ token.

This is also to ensure the sustainability of our vaults, where users will always have an incentive to keep the vault compounding in the long run as long as there is TVL and fees.

Harvest Vault

The "Harvest Vault" function triggers a rebalance of the vault, by harvesting incentives, swapping them and compounding them back into the vault.

It is not required to press on the "Harvest Vault" function. Our automation processes will handle this in the back end.

Only do this if you want to earn the harvester fees, or if you would like to compound the rewards before exiting the vault.

Harvest Merkl Rewards

The "Harvest Angle Merkl" function triggers our strategy to harvest the pending incentives from Merkl, convert the tokens to the vault tokens, and compound them into the vault.

Harvesting consumes gas fees.

Last updated