Intro to ACryptoS

ACryptoS - Advanced Crypto Strategies

We automate high-yield DeFi strategies for you. Simply deposit your tokens and watch your holdings grow.

Here at ACryptoS - we maximize your APY with our performance-oriented algorithms.

No complex setups, no constant monitoring. We handle the rest.

Main Products

Single-Token Vaults

- Exposure to one token. No impermanent loss (IL) risks - Better yields than just supplying on lending protocols

2-Token Concentrated Liquidity Vaults

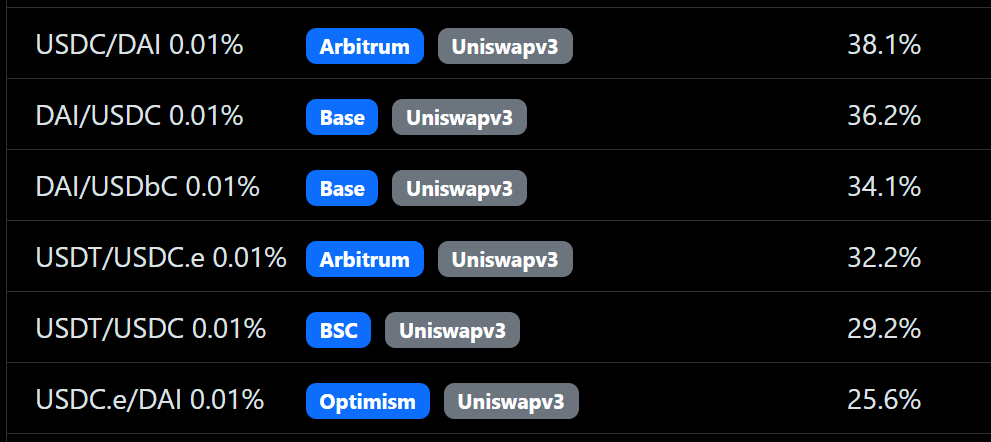

- Automated Conc. Liquidity Manager (ACLM) on Uniswap V3 and other CL DEXs - Data-proven highest performing strategies, for stablecoins and other big-cap pairs

Why use our Vaults?

4 years+ track record for deployment of highly effective DeFi Strategies

SAFU, careful risk management

Sustainable APY for long term growth

Translated to real-life examples:

Get 20-30%+ APY for a stablecoin pair, consistently for many months, not via farming tokens but from sustainable swap fees, with funds deposited on Uniswap V3 - one of the most solid DEXs in DeFi.

And, we've had no code exploits ever, since our launch in 2020.

If these appeal to you, read on.

Who is this for?

Single-Token Vaults: DeFi users opting for low-risk steady growth of their tokens. Deposit and let grow, while complex algorithms run behind the scenes, achieving strong single-token APY.

ACLM Vaults: Simplified liquidity providing for V3 pools. Stable Strategies (eg. USDC/DAI or wstETH/ETH) offer attractive APYs for relatively low risks, while Volatile Strategies (eg. ETH-USDC) help users manage & rebalance their positions on V3 LPs, reducing the burdens of constantly monitoring their holdings.

👇 Dive in for some detailed explanations on how these Vaults and Strategies work:

Single-Token VaultsACLM - Advanced Concentrated Liquidity Manager👉 or opt for this Quick-Start TL/DR guide.

Links

dApp: https://app.acryptos.com

Telegram: https://t.me/acryptos

Twitter: https://twitter.com/acryptosdao

Medium: https://medium.com/acryptos/

Other links can be found here.

Last updated